Content

The cash flow statement (CFS) measures how well a

company generates cash to fund its debt obligations,

cover its operating expenses, and fund additional

outside investments. Effective accounting practices demand a litany of skills and knowledge, and fiscal acuity is especially critical for time and resource-challenged small- to medium-sized organizations. Enter the Chart of Accounts, aka COA, for our current consideration, as a key metric of financial health. A chart of accounts (COA) is a financial, organizational tool that provides an index of every account in an accounting system.

Each of these is broken down

into sub-categories to further articulate more

granular characteristics. Since the chart of accounts creates a listing of all accounts as found within the general ledger, it contributes to the creation of the double-entry bookkeeping system as well. In other words, the chart of accounts lists all the information provided in the general ledger and then uses specific codes to denote the bookkeeping transactions. For example, to report the cost of goods sold a manufacturing business will have accounts for its various manufacturing costs whereas a retailer will have accounts for the purchase of its stock merchandise. Many industry associations publish recommended charts of accounts for their respective industries in order to establish a consistent standard of comparison among firms in their industry.

How To Make a Chart of Accounts

It can be one of the most confusing items on financial reports, especially if the approach is not well-organized and simple. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. A chart of accounts is a list of account names used to label transactions and keep tabs on a company’s finances. Think of it as the filing cabinet for your small business’s accounting system.

- Accordingly, financial statements can be no more detailed or informative than the underlying chart of accounts structure.

- It assists with management reporting and is critical for meeting the demands of regulatory compliance.

- The accounts which are usually presented first are the balance sheet accounts, which are followed by the income statement accounts.

- You can organize your chart of accounts with sub-accounts based on your business needs.

- Liabilities may often have a “payable”

descriptor (i.e., AP) attached to them.

An organization’s financial statements are those

records that convey all its related business transactions,

wellbeing and status, and the overall financial

performance of the entity. There is a generally accepted numbering structure for the accounts, so everyone’s accounts appear in roughly the same order and with similar numbering. Account numbers can be appended with three- or four-digit indicators to include added data to signify divisions, parts, products, etc. These are created depending on business composition (large, small, complex, simple) or how detailed its transaction descriptions may need to be. In such a case, each transaction makes two entries, one for the debit and one for the credit.

Market & list your units online

Again, using the multiple three- or four-digit sub-account designations will provide more in-depth transaction tracking and overall fiscal transparency. All the account types are either part of income statements or balance sheets. In this instance, the current liabilities listed in Crumbs Bakery’s chart of accounts belong to the balance sheet statement. A COA is a listing of all the financial accounts in a company’s general ledger (GL). They are grouped into categories that correspond to the structure of an organization’s financial statements. These GL accounts are used to categorize every financial transaction a company makes and offer even an outsider a holistic view of an organization’s assets, expenditures, and income, all in a single place.

- Start by assigning names to your business accounts—descriptions such as “Equipment,” “Accounts Payable,” and “Utilities.” This will be the middle column of your chart.

- The following examples illustrate how a fictional business—XYZ—might record transactions in its chart of accounts.

- The asset ledger is the portion of a company’s accounting records that detail the journal entries relating only to the asset section of the balance sheet.

- That way if actual supplies and repairs total $2,700 for the month, you can see at a glance that indirect cost was overapplied to projects ($3,000 applied, compared to $2,700 actual).

Understanding which accounts you need can be complicated, and it’s not always easy to change something later. An accountant or bookkeeper can help you create https://www.bookstime.com/articles/chart-of-accounts a customized CoA or rework your existing CoA. Building the right CoA for your business can set you up for success in terms of reporting and tax filing.

Chart of Accounts FAQ

The chart of accounts should give anyone who is looking at it a rough idea of the nature of your business by listing all the accounts involved in your company’s day-to-day operations. There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key. The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system.

- One such statement is the chart of accounts (COA), which is a cause of confusion for many SMB leaders.

- But it’s easier to use software that builds a chart of accounts for you.

- There, the chart of accounts is created automatically for you, using a default CoA structure that works just fine for many businesses.

- It is generally better to have less detail and keep it accurate than to have inordinate amounts of detail that tend to be inaccurate.

- From the data in your chart of accounts (CoA), you can run almost any financial report you need.

- Again, using the multiple three- or four-digit sub-account designations will provide more in-depth transaction tracking and overall fiscal transparency.

Below, we’ll take you through 3 basic steps and provide multiple examples and templates that will give you a better idea of how to put together your own chart of accounts. Understanding how your chart of accounts works is a crucial skill for finance leaders and business owners alike to master. A well-organized chart of accounts is a great tool for obtaining funding or loans. Using your chart of accounts, you can easily eliminate options that don’t make sense until you come across the account that fits your entry most accurately. Smaller organizations, on the other hand, may decide to hold fewer account subtypes to keep their chart of accounts concise and easy to interpret. At a minimum, your chart of accounts should include an account number and name for each account.

Step #3: Organize account names into account types

A well-executed remodel can generally be implemented within a month and have a noticeable effect on financial reporting immediately. Good month-end financial reports are made accurate with large non-cash https://www.bookstime.com/ journal entries. For example, if wages earned from October are paid on November 7, a journal entry must be posted to move that November 7 cash expense to October 31, to make October financials accurate.

How to use travel rewards for the best value – Fortune

How to use travel rewards for the best value.

Posted: Tue, 06 Jun 2023 13:26:00 GMT [source]

In conclusion, the standard chart of account is useful for analyzing past transactions and using historical data to forecast future trends. You can use the following example of chart of accounts to set up the general ledger of most companies. In addition, you may customize your COA to your industry by adding to the Inventory, Revenue and Cost of Goods Sold sections to the sample chart of accounts. To make it easier for readers to locate specific accounts, each chart of accounts typically contains a name, brief description, and an identification code. Each chart in the list is assigned a multi-digit number; all asset accounts generally start with the number 1, for example. A chart of accounts (COA) is an index of all the financial accounts in the general ledger of a company.

What is the difference between a COA

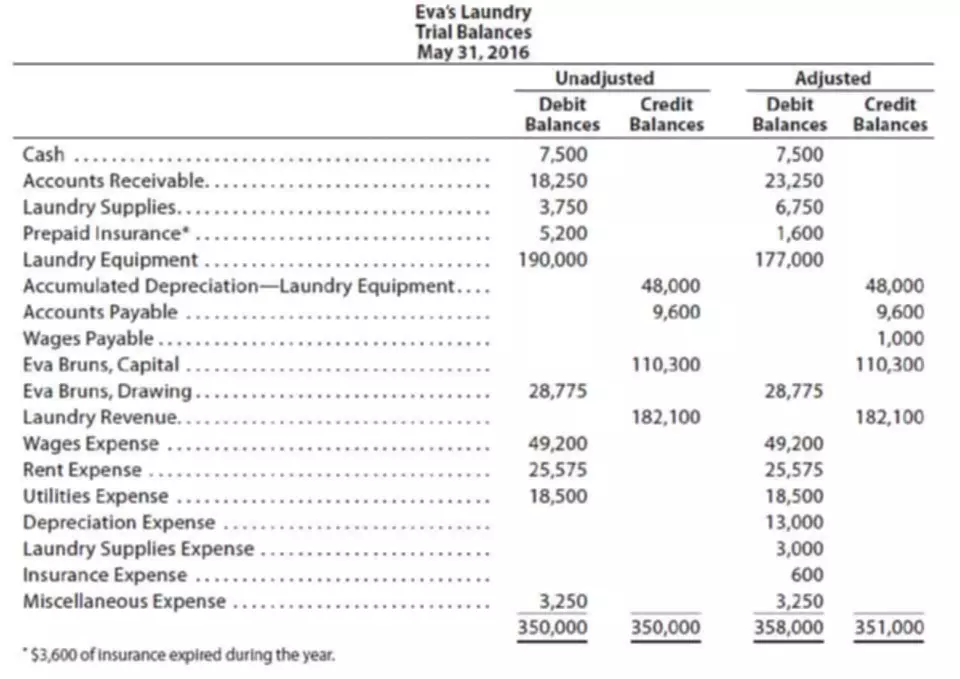

While it sounds great in theory, in practice financial statements are what get faithfully generated and reviewed by management each month. Detailed reporting from the various modules often requires some effort to make sure it ties to the financials, and because of that (and other reasons), it doesn’t consistently get done. Building some level of detail into the chart of accounts is a practical way to ensure key information is always in the face of the management team. A general ledger represents the record-keeping system for a company’s financial data with debit and credit account records validated by a trial balance.